|

With 2023 underway, and the latest Bank of Canada rate increase to 4.5%, combined with the stress of the increased cost of living on Canadian households, the questions that are on everyone’s minds are… where will rates go from here, and what does this mean for the housing market? While no one has a crystal ball, the good news is that most economic forecasts are projecting this to be the last rate hike for some time and that the predicted recession later this year will be a relatively quick one – expected to end in 2024. Although the latest rate increase in January wasn’t welcome news, this projection does mean some positive things as we go through 2023. First of all, if you plan on selling or buying a home, this forecast may suggest some stability in the housing market. This means it’ll be easier to price and negotiate if you’re selling, and if you’re buying, it’ll mean that you can shop the market with confidence that you’re purchasing at what is most likely as close to the dip in the market as economists are forecasting. It is important to call me to get a pre-approval prior to making any offers, as any rate increases may affect your buying power. If you are planning on sitting tight in your current home, 2023 really is about finding ways to adjust for a lot of Canadian families. If we assume the forecasts are correct, we now know what we’ll have as a budget for the next 12 months. The relative short timeframe of the predicted recession means that no matter your situation, there is probably a short-term solution we can work towards to help with cashflow over the next year. If you’re looking at making a move once the recession is over, which is expected to be in early 2024, it’s important we touch base to review your options. It is widely expected that The Bank of Canada will lower overnight rates to spur the general economy post-recession, and this will have a tangible effect on the real estate market due to pent-up demand, which will be exacerbated by an undersupply of housing stock. As a result, you’ll want to make sure you’ve got everything you need in place and know exactly what you will be able to buy. No matter what camp you fall into over this year and next, it’s important to be prepared prior to making any decisions. Give me a call, and we can put together a plan that’s most advantageous for your individual situation. Did you know? The deadline to contribute to your RRSP this year is March 1. Your home may be the perfect tool to pay yourself first and grow your net worth. Here are three quick tips that can help make that happen, even in a more challenging economic climate.

Paul Trainor, LLQP | Atlantic Business Federation:

One Stop Professional Services: Our Team Offers In House: Mortgages . Real Estate . Insurances . Website Management & Development . Marketing . Logo Designs . Health & Dental . Drone Services . Podcast Studio . Photography . Bookkeeping . Financing . Private Lending . Working Capital . Refinancing . Branding . Social Media Administration & more... 330 North River Road, Charlottetown, PE C1A 3M5 Cell/Direct: 902.940 5927 Toll Free: 1.844.940.5927 Toll Free Fax: 1 844 363 6243 Email: [email protected] www.atlanticbusinessfederation.com

0 Comments

We were pleased to sit down with Assumption Life Assurance Company: Daniel Audet. MBA Associate Vice-President, Individual Insurance and Investments and Mehdi Saghir Business Development Manager. Topics included: Better Mortgage Insurance Mortgage Insurance VS Bank Insurance 5 reasons why FlexTerm is a better mortgage protection solution Complete Mortgage Protection: Life, Disability & Critical Illness Also see topics not discussed but shows Assumptions complete list of products and services: Including Life and Investments. Term Life Insurance Permanent Life Insurance Living Benefit Participating Life Insurance Guaranteed Interest Accounts Planning for a project or retirement Retirement Income Options SmartSeries Investment Options Find an Advisor To get an online quote on this or any other products please visit:

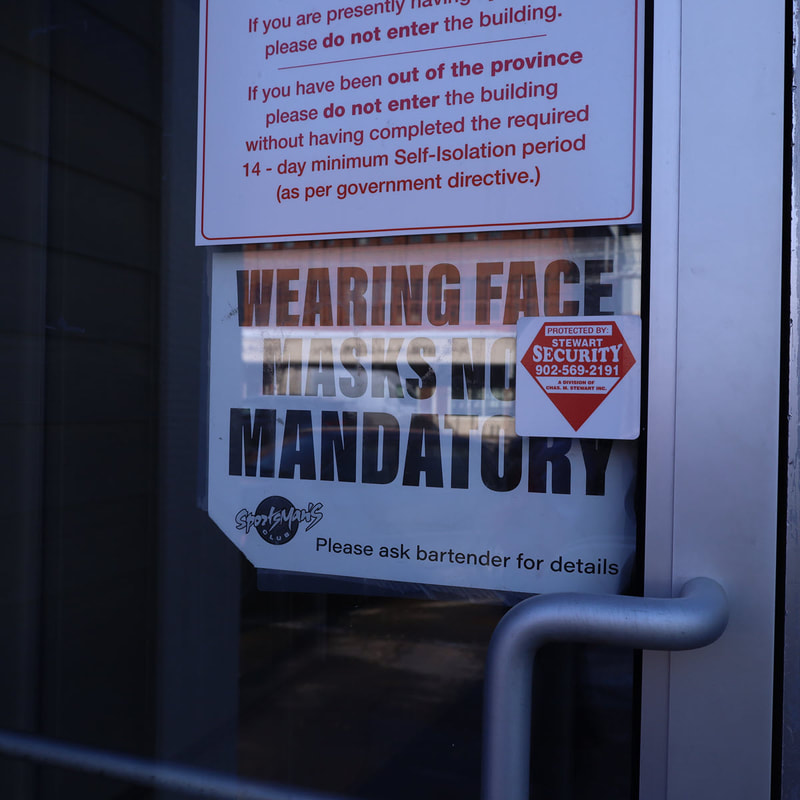

PEI: https://bettermortgageinsurance.ca/pei Nova Scotia: https://bettermortgageinsurance.ca/nova-scotia New Brunswick: https://bettermortgageinsurance.ca/newbrunswick 902 940 5927 or Toll Free 1 844 940 5927 [email protected] On a week when a judge ordered protesters at the Ambassador Bridge over the U.S.-Canadian border to end the 5-day-old blockade thousand and thousands of Canadians and Islanders joined forces to peacefully protest against vaccine mandates, vaccine ID cards and mask restrictions that literally have ruined the lives and livelihood of thousands of small business owners and staff, caused serious mental health issues and financial ruin for many islanders and their families and friends. The overriding message from participants and by standers is its time to stop the fear and get back to living life again.

Unfortunately politicians did not meet or give any speeches to the crowd but the P.E.I. government intends to drop the requirement for Islanders and visitors to isolate for four days after arriving at an entry point. It was imposed in late 2021 when Omicron variant case numbers began to rise elsewhere in Canada. Although this is a start, government sponsored ID segregation and mask mandates are yet to be eliminated, but hopefully there will be an announcement soon on these policies. Now there is widespread community transmission on the Island, almost all of these cases are very mild. The convoy had trucks, cars, tractors and big wheel trucks and all very cheerfully and peaceful agreeing that its time to end these mask mandates, ID card registrations and vaccine cards restrictions and get back to building an economy decimated by the virus and governments restrictions on its populations. With close to 93.7 per cent of residents over 12 had gotten at least two shots of a COVID-19 vaccinated, and 67.4 per cent of children aged 5 to 11 had at least one dose so its time to stop and try to heal. We are unsure of the devastation on small business: closures, job loss, suicides - it probably never will be publicized - but we have seen hundreds of job losses, business closures and financial ruin just in PEI. Here at Atlantic Business Federation we agree with the stand of Islanders to end these vaccine mandates and ID card registrations. Obviously it was important to monitor the virus once it started and we agree it was a necessity, but now is the time to take of these masks and stop segregating the population. Presenting ID cards to eat, restrictions on places of worship and family gathering just seems like a time that we should never go back to. Paul Trainor is vice president and General Manager of PEI and Atlantic Business Federation. Please contact us anytime at 902 940 5927 or email [email protected] for feedback and conversation. Photos courtesy of Virtual Creations Photography . www.virtualcreations.ca |

Keep informed on PEI Business news at PEI Business Federation.

902 940 5927 We provide group benefits and services to PEI Business & their valued employees. Archives

February 2023

Categories |

- PEI Business

- Business News

-

Business Services

- PEI Podcast Rentals

- Photographer Services

- Point of Sale Visa MC Debit

- PEI Bookkeeping & Accounting Services

- PEI Marketing & Promotions

- PEI Signs and Printing Services

- PEI Training, Courses, Online Study

- PEI Computer, Software Discounts

- PEI UPS Shipping & Courier Services

- PEI Business & Personal Services

- PEI Telephone/Cellular/Long Distance

- PEI Drone Services

- PEI internet service provider

- PEI Web Presence Grant

- PEI Furnace Oil Savings

-

Insurance Services

- PEI Employee Benefits

- Mortgage Insurance PEI

- Guaranteed Issue Health Plans

- Blue Cross Travel Insurance

- PEI Auto Insurance

- PEI Home Insurance

- PEI Business Liability Insurance

- PEI Disability Benefits

- Application for Disability Insurance

- PEI Life & Personal Insurance

- Application for Life Insurance

- PEI Business Overhead Insurance

-

Financing Services

- Credit Card Rewards Program

- PEI Wills and Estate Planning

- Atlantic Equipment Financing and Leasing

- PEI Mortgage Brokers

- PEI Point Of Sale Benefits

- Businesses for Sale, Rent or Lease

- PEI Small Loans Financing

- PEI Financial Advisors

- PEI Bankruptcy & Debt Management Services

- PEI Loans, Lending, Financing and Banking

- Web Services

- Register

RSS Feed

RSS Feed